When you receive wages from your employer, they will have withheld 6.2 percent of your wages to pay your share of the Social Security tax. (This is usually identified as FICA —Federal Insurance Contributions Act—and not “Social Security”).

Because the total Social Security tax on wages is 12.4 percent, your employer is required by law to pay the additional 6.2 percent. In spite of the deserved popularity of the Social Security program, the tax levied on workers to pay their share is far more of a burden to moderate and low-income people than highly compensated workers.

Reason? A highly compensated employee only pays the 6.2 percent tax on the first $118,500 of income. That equals $7,347— the maximum amount any wage earner in the U.S. must pay in Social Security tax for tax year 2015. However, you do not pay Social Security tax on dividends you receive from stocks. Nor do you pay Social Security tax on interest payments you receive from bonds issued by corporations, the U.S. Government or state and local governments.

If your wages were $80,000 a year and you received an additional $80,000 in dividend income from stocks your grandfather left you in his will, then you will only pay Social Security tax on the $80,000 in wages you received.

If you are really, really rich, you get an even better deal. Forbes Magazine ranks Microsoft founder Bill Gates as the wealthiest person in America, with a fortune of 76 billion dollars. For purposes of illustration, let’s assume Gates receives a salary of one hundred million dollars a year from Microsoft.

How much Social Security tax does he pay? Because the Social Security tax of 6.2 percent is only applied to wages of $118,500 or less, Bill Gates would pay $7,347 in Social Security tax. Pocket change to him. If the 6.2 percent were applied to his hypothetical one hundred million in wages, then Gates would pay $6.2 million

dollars in social security taxes. Still pocket change to him. But probably a more equitable amount given his wealth.

If you make $20,000 a year, you pay 6.2 percent in Social Security tax or $1,364 a year. Obviously, this represents 6.2 percent of your annual income. If you make $100,000,000 you pay .007347 percent of your annual income in Social Security tax. Quite a difference.

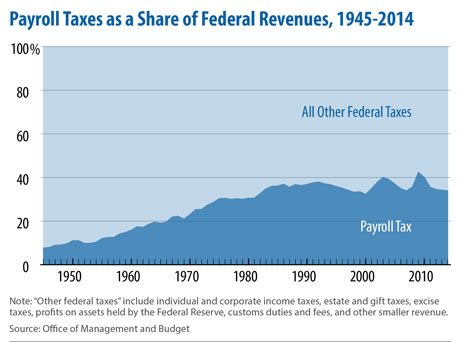

Bill Gates is hardly the norm. A more realistic scenario comes from the Center on Budget and Policy Priorities, which examined Social Security taxes across the working population of the US. “The bottom fifth of households paid an average of 6.6 percent of their incomes in payroll tax in 2014 … while the top 1 percent of households paid just 2.3 percent,” The center reports. This figure includes the employer and employee shares of the payroll tax.”

As important as Social Security is to Americans, somehow the people who pay the highest percentage of their income in taxes to support the program, earn the least amount of money. Welcome to America.