With all the hype about tax day, it’s good to know just what is going on when it comes to money to help the poor. Each municipality has the ability to tax things in its jurisdictions to collect revenue to improve its economy and lifestyle.

For example, Washington, DC., has a recycling effort called the bag tax — five cents charged for every bag used. Most stores are required to charge this tax. The program has triggered a very pressing question. Just how much do we pay in taxes in our local jurisdiction and do those tax dollars ever reach the common citizen?

There are those that have said Washington, DC, is doing everything in its power to address the needs of its most vulnerable population.

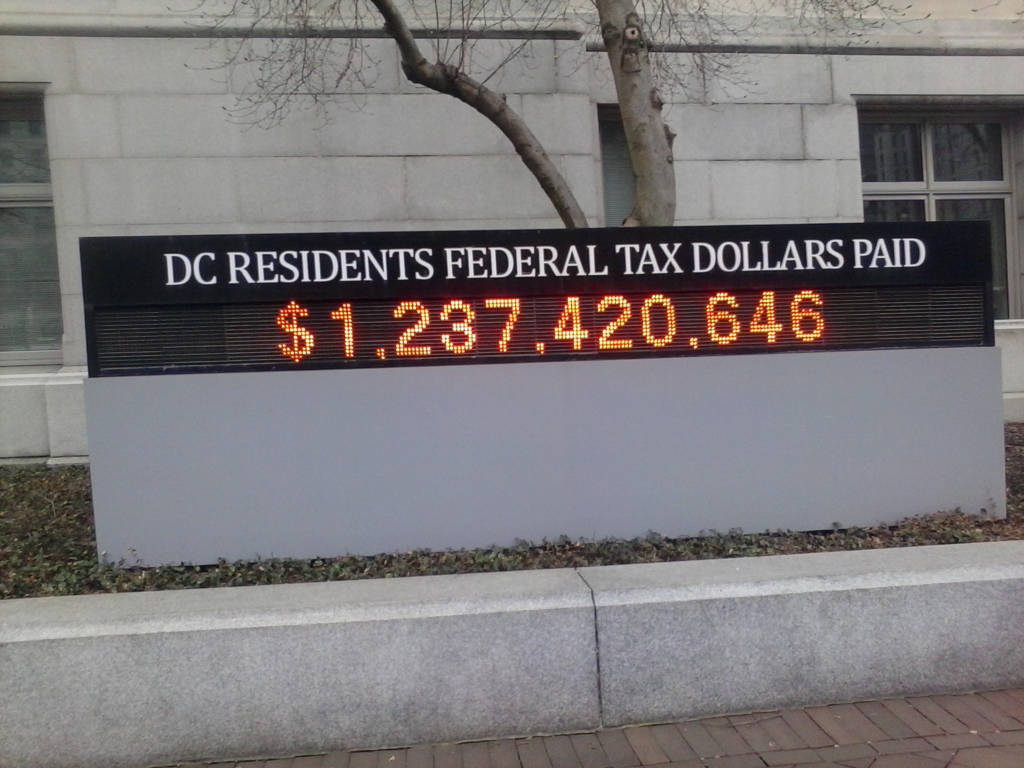

The district is a unique municipality because it pays federal taxes and has no official representation in Congress. As of April 3, the sign outside of the John A. Wilson building read that Washington has paid $1,237,420,646 in taxes so far without representation in Congress. How much of this money is dedicated to the poor and more importantly, how much of this tax do poor individuals pay?

In an experiment, a reporter decided to track purchases and see how much tax a homeless individual like myself would have paid through purchases at local stores all over Washington, DC.

Since March 25, about $11.97 was spent on sales taxes for various items. Things like a coffee from McDonald’s incurred a 10-cent tax, and that was the low end of the spectrum. A purchase of shoes incurred more than two dollars worth of taxes, whereas a cell phone bill incurred more than five dollars. With all these different tax charges, how much of the money really reaches the poor?

The District of Columbia Housing Authority has closed its waiting list with names of about 70,000 people — a large majority of whom are probably still in Washington, DC. — so it’s prudent to ask where the money goes. These are charges on items bought in Washington, D.C.

The three main public entities that fund affordable housing programs in the District are the District of Columbia Housing Finance Agency, The Department of Housing and Community Development and the District of Columbia Housing Authority. The three had combined budgets of $813 million in fiscal year 2013.

But how much of that money is taken from sales taxes that increase the cost of the items bought by residents who need the very services those agencies offer?

Even more importantly, how is it that there are low income resources that were just left out of the loop?

It seems we here in Washington, D.C., must take a closer look at how our tax money is spent.

It is clear that homelessness has to end, but how do we get there?

One way will be to look at exactly how much we pay in local municipality taxes.

Another would be to change the way we decide who counts as a taxpayer.

If you buy something in a local store, no matter if you are a resident or someone passing through, you are contributing to that jurisdiction. These tax revenues belong to all of us because we are the ones who paid them in the first place.