Washington, D.C.’s wealthiest residents pay a lower share of their earnings in D.C. taxes than its middle-income residents, a recent report published by the D.C. Fiscal Policy Institute found.

Policy director Tazra Mitchell and policy associate Danielle Hamer co-authored the tax inequity report, analyzing data gathered by the national nonprofit Institute on Taxation and Economic Policy. The D.C. Fiscal Policy Institute, which, according to its website, seeks to influence “D.C. budget and policy decisions to reduce poverty and income inequality,” released the report last month, ahead of when Mayor Bowser was expected to release her proposed fiscal year 2022 budget.

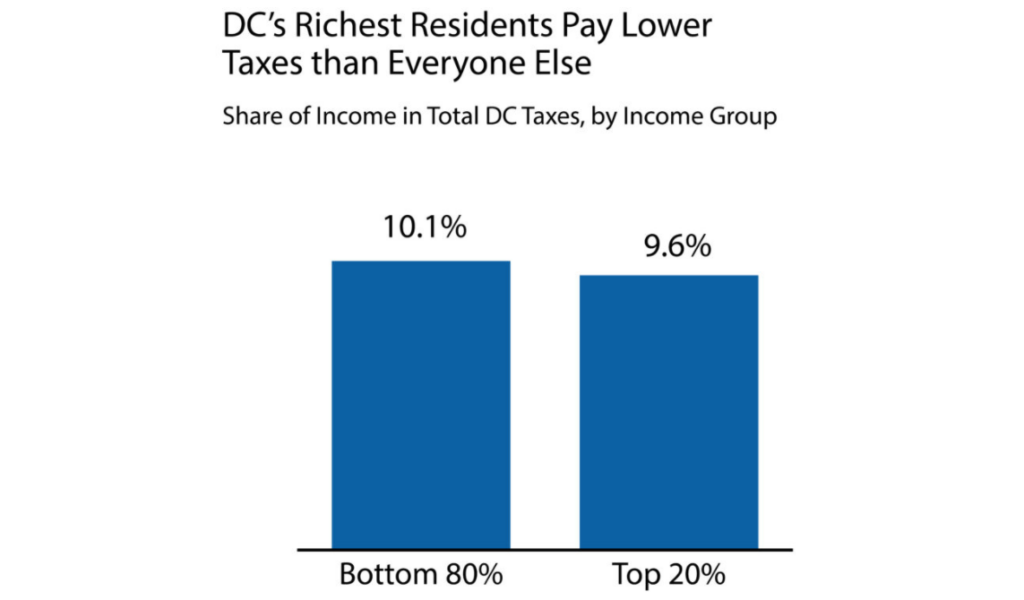

Mitchell and Hamer found that D.C. residents with annual incomes over $919,000 pay 9.5% of their earnings in D.C. income, property, and sales taxes. Meanwhile, middle-income residents pay 10.5% of their earnings. Only those making less than $24,000 per year — the bottom 20% of earners — pay smaller shares in taxes than D.C.’s richest 1% of residents. The report also showed that the city’s richest 20% of residents, who pay an average of 9.6% of their earnings to the District, pay less in taxes as a share of income than the bottom 80% of residents, who pay an average of 10.1% of their earnings.

“We have multimillionaires paying a tax rate on added earnings that is just slightly higher than the rate for teachers and nurses earning $60,000 a year,” Mitchell said in an interview.

The report partly attributes this disparity to the fact that lower-income residents “spend most of their earnings to get by,” accruing more sales and excise taxes in the process, while wealthier residents “can afford to save and therefore spend a relatively small share [of] their income on taxable goods and services.”

Similarly, the report notes that “D.C.’s lowest-income residents pay a larger share of their income in property taxes than higher-income families … in part because D.C.’s rising rents mean that property taxes paid by renters have risen substantially.” Meanwhile, D.C. law allots financial relief for (generally wealthier) homeowners, including a 10% cap on how much a tax on the value of a house can increase annually. Mitchell and Hamer conclude that this provides the most relief for homeowners in neighborhoods “where home values are rising fastest.”

A 2018 report by the D.C. Policy Center stated that provisions such as the homestead deduction and property tax cap, which give large tax breaks to homeowners in gentrified areas but no relief to renters, “result in amplified inequalities which are sharper along racial lines.” A 2019 D.C. Fiscal Policy Institute report also highlighted property tax differences as an example of racial inequity in D.C.’s tax code, emphasizing that “some 56% of D.C. homeowners are white, while 36% are Black and 7% are Latinx,” which the think tank attributed to D.C.’s long history of redlining, racial covenants, housing discrimination, and other policies precluding BIPOC residents from homeownership.

“Cuts for mansions,” the 2019 report argued, constitute “a recipe for wider inequity in D.C.”

[Read more: Preliminary recommendations from the mayor’s rental housing strike force did not mention did not touch on tax relief]

In March’s tax analysis, Mitchell and Hamer argue that the D.C. tax code does not do enough to close the gap in “the income and wealth inequalities created by systemic racism.” Despite the fact that, on average, white households in the District earn more than twice as much as Black households, “the share of all D.C. taxes paid by the richest white residents — 42% — is basically the same as their share of overall D.C. income, which is 41.5%.” To address racial inequity in income and wealth, the authors say, D.C. should tax higher-income residents at a much higher rate. Current tax disparities, Mitchell said, are “just not living up to the progressive values that D.C. has.

She added that, ahead of the proposal, debate, and passage of D.C.’s fiscal year 2022 budget, a process that began April 22, the role of taxation in addressing racial inequity in D.C. is especially important. “We know that the budget is going to be one of the most important budgets in D.C.’s history,” Mitchell said. “This year’s budget choices have the potential to address the ongoing damage and suffering caused by the pandemic and really put D.C. on the path for recovery that addresses longstanding racial inequities exacerbated by the pandemic — but only if our leaders seize the opportunity to make bold investments.”

One key part of that opportunity, according to the DCFPI report: overhauling a tax code that has long protected wealthy, predominantly white residents at the expense of everybody else.

“Our leaders should find the resources needed to put us on the path towards a stronger and more equitable community,” Mitchell told Street Sense Media.

But such an effort, she added, requires an acknowledgment that “tax justice is racial justice.”