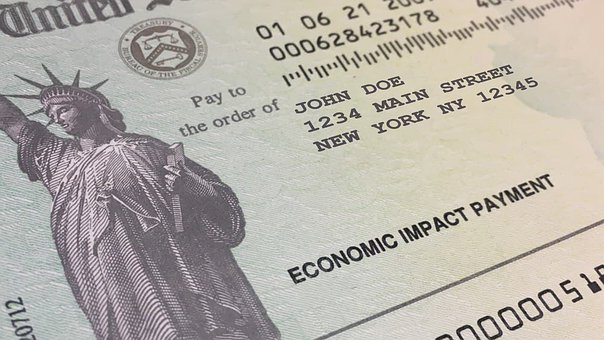

In order to claim the $1400 stimulus payment owed to residents with low incomes through the American Rescue Plan, eligible people experiencing homelessness should file their 2020 taxes as soon as possible, according to IRS officials. Tax assistance resources available to people with low incomes in the D.C. area are listed at tinyurl.com/2021-stimulus-tax-clinics.

Since the $1.9 trillion package was signed into law on March 11, the IRS has sent out 90 million economic impact payments through direct deposit, mailed checks, and IRS-issued debit cards. Anyone making less than $75,000 per year is eligible for the $1400 checks, meaning that half of the projected 160 million payments have been completed.

As was the case for the first two rounds of economic impact payments, stemming from the CARES Act passed last March and the COVID relief package passed in late December, the latest checks were automatically sent to most recipients. People who have filed their 2019 or 2020 tax returns and people who receive certain federal benefits — including Social Security retirement payments, survivor or disability benefits, Railroad Retirement benefits, Supplemental Security Income, or Veterans Affairs benefits — should not have to take additional steps to receive the third payment, referred to as “EIP3.”

But many people experiencing homelessness who are eligible for a stimulus check have not received it because they neither receive benefits nor earn enough annually to be required to file taxes and are largely unknown to the IRS; to access the $1400 they are owed, they should file a 2020 tax return, even if nothing is owed.

In a previous interview with Street Sense Media, Joseph Leitmann-Santa Cruz, the CEO and executive director of Capital Area Asset Builders, noted that many people experiencing homelessness do not file income taxes due to the common misconception that a permanent address and a yearly income are both required to do so. On the contrary, he said, would-be filers with little-to-no income are encouraged to use the address of a trusted non-profit or shelter and complete their tax forms – enabling them to access thousands of dollars in stimulus payments and tax credits that will otherwise go unclaimed.

[Read more: Tax assistance available for low-income people facing challenges collecting credits and stimulus checks]

Filing a 2020 tax return is especially important, stressed IRS Commissioner Chuck Rettig in his testimony to the Ways and Means Committee on March 18, as filers can recover the previous two rounds of stimulus payments through the Recovery Rebate Credit, can claim the third payment, and can access typical low-income tax credits like the Earned Income Tax Credit and the Child Tax Credit. The disbursement of these funds is “trigger[ed] off of the filing of a return,” he said, “so we need to get folks to actually file the returns.” Deacon Jim Shanahan, director of the Financial Stability Network at Catholic Charities D.C., added that for non-filers who have children, “the added benefit of filing a 2020 tax return is that the IRS will know where to send the new monthly Child Tax Credit checks this summer.”

[Disclosure: Jim Shanahan of Catholic Charities and this reporter are members of the same Catholic parish in Maryland.]

People making less than $56,000 per year can access filing help at a series of low-income tax clinics throughout the D.C. region. Virtual appointments, limited drop-off and pick-up services, and very limited in-person assistance opportunities are available throughout the filing season. The materials required to use these services include a social security number, a government-issued photo ID card, and necessary tax documents. If you do not have a social security number or photo ID, it is recommended that you contact a VITA site to speak with a tax professional.

For people making less than $72,000 a year, the IRS also offers the Free File Tool, which can be used to quickly file tax forms online.

Unlike the previous two rounds of economic stimulus, the IRS is not offering a non-filer tool on its website. IRS officials underscored the need for would-be recipients to file their 2020 taxes immediately in order to access their checks.

Mike Littman, a volunteer tax preparer at Catholic Charities VITA, stressed that “if you did not file in 2019, filing in 2020 [as soon as possible] is the best way … both to recoup what you didn’t get last year and to get the new EIP this year.” He also noted that, while they are no longer available at the IRS online portal, some non-filing options are available to those who seek assistance at VITA programs.

The tax filing season opened on Feb. 12 and will remain open through the recently extended deadline of May 17. Littman and other tax professionals urged those who are eligible to receive EIP3 to seek assistance at low-income tax clinics and file their taxes as soon as possible.

Local tax assistance

[su_tabs]

[su_tab title=”General resources (DC)” disabled=”no” anchor=”” url=”” target=”blank” class=””]

Capital Area Asset Builders

www.caab.org/en/dceitc

(202) 419-1440

Financial Stability Network of the Catholic Charities of the Archdiocese of Washington*

www.ccvita.org

Community Tax Aid *

www.communitytaxaiddc.org/free-tax-assistance/feb2021/

(202) 547-7773

United Planning Organization*

Website: www.upo.org/taxprep/

(202) 238-4609

*For filers making less than $56,000 per year.

UDC VITA Tax Clinic

www.udc.edu/sbpa/sbpa/vita-tax-clinic/

(202) 274 – 7000

United Way of the National Capital Area

www.unitedwaynca.org/programs/economic-opportunity/tax-prep-vita/

(202) 488-2000

[/su_tab] [su_tab title=”Legal disputes” disabled=”no” anchor=”” url=”” target=”blank” class=””]

UDC Law Tax Clinic

www.law.udc.edu/page/TaxClinic

(202) 274-7315

[/su_tab]

[su_tab title=”DC low-income clinics” disabled=”no” anchor=”” url=”” target=”blank” class=””]

UPO Ralph Waldo “Petey” Greene Community Service Center*

2907 Martin Luther King Jr Ave SE, Washington, DC 20032

Type: Drop-Off Only

2/8/2021 – 4/15/2021

(202) 231-7903

*Mon-Thurs; Spanish language available; no walk-ins allowed

Woodbridge Library

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Turkey Thicket Recreation Center

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Shaw Library

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Petworth Library

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

King Greenleaf Recreation Center

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Georgetown Library

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Emery Recreation Center

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Chevy Chase Community Center

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Bellevue Library

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

Catholic Charities VITA*

Type: Virtual

2/1/2021 – 4/15/2021

[email protected]

*Spanish language available

Anacostia Library

Type: Virtual

2/12/2021 – 4/15/2021

[email protected]

(202) 642-9037

[/su_tab]

[su_tab title=”Maryland and Virginia low-income clinics” disabled=”no” anchor=”” url=”” target=”blank” class=””]

Prince George’s Community College*

301 Largo Rd, Largo, MD 20774

Type: Drop-Off, Virtual

Start/end dates unclear

[email protected]

(301) 546-0713

*Multiple languages offered

Enterprise Development Group

901 S Highland St, Arlington, VA 22204

Type: In-person by appointment

Start/end dates unclear

[email protected]

(571) 321-6976

[/su_tab]

[/su_tabs]