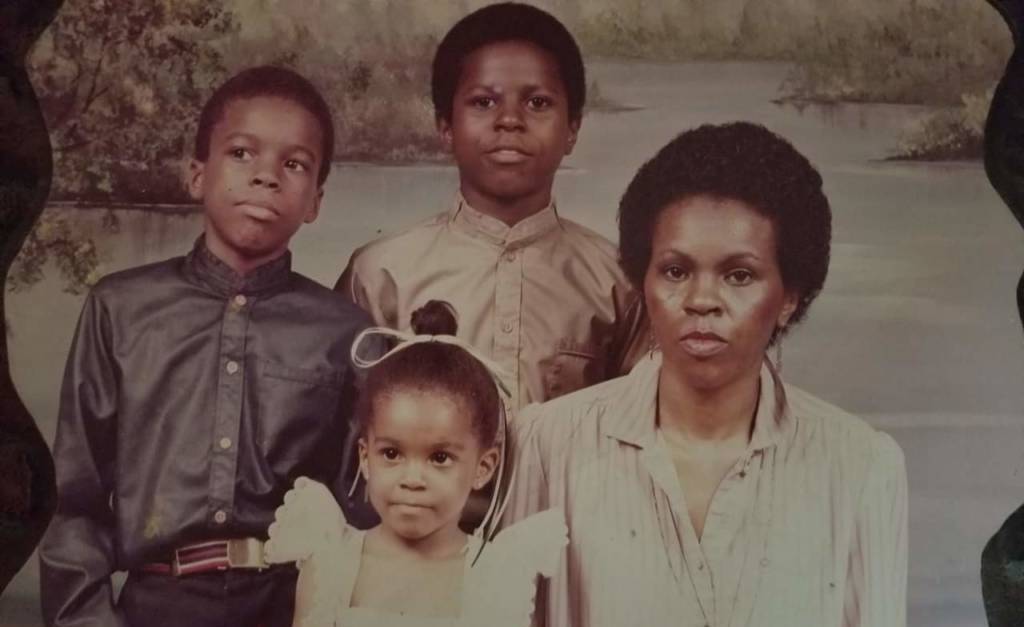

Mattie Palmore promised her ex-husband that every time she got paid, she would give him the money. But he would not pay rent and made bad investments. When she needed money to feed her kids, he refused.

“I would have to go while he was sleeping to steal it … We got evicted one time because he refused to pay. He didn’t think he owed anyone.”

Financial abuse is often not taken as seriously as other forms of abuse. However, it occurs in 99 percent of all domestic violence cases and can often force women to stay in unhealthy relationships longer than they otherwise would.

“I have yet to talk to anyone where I couldn’t find financial abuse in some context,” said Kim Pentico, director of economic justice program, a part of the National Network to End Domestic Violence. “From stealing money, to taking credit out in someone else’s name, to saying they will pay a bill and not doing it, overusing credit cards.”

Pentico said one of her client’s abusers told his victim to buy a cell phone with a two-year contract, only to have the abuser smash the phone within the first month. Pentico’s client ended up accumulating debt from the phone bill, which kept her from qualifying for state housing.

Financial abuse is a tactic abusers use to maintain power and control. Other tactics include isolation, threats, use of children and intimidation. Financial abuse can include anything from preventing a victim from getting a job, to giving him or her an allowance or just taking their money.

Palmore, co-founder of The Women’s Group of Mount Vernon and an advocate for victims, said her abuser’s friends would wait outside of her work to see how many overtime hours she was working. Then, her abuser wanted the extra income.

“He would be in the car and stop the car and slap me because I wouldn’t give him money,” Palmore said. “He thought I was supposed to give him money to do crazy things.”

In many cases, financial abuse can force women to stay in unhealthy relationships longer because they depend on their partner financially. Three out of four domestic violence victims said they stayed with their abusers for economic reasons in a 2012 survey conducted by the international cosmetics company Mary Kay. “There are a lot of the women that have significant others that have provided financial supports and gifts, and they have to choose whether to maintain the relationship or to eat,” said Lolita Mason, a program manager at New Endeavors by Women, a nonprofit that strives to end the cycle of homelessness in D.C.

Even if a victim can sever a relationship with an abuser, the economic damage already done can affect her or his future financial options — from housing to credit to taxes.

Collection agencies rarely take mercy on victims who have large amounts of credit card debt due to an abuser, according to Lisalyn Jacobs, a legal expert on domestic violence and CEO of Just Solutions. Those same victims may then have their application to lease an apartment without their abuser denied when the landlord runs a credit check.

A similar situation can happen with employment, according to Pentico. Often an abuser will harass a victim by contacting his or her coworkers at the office, which makes the victim look like a liability in the workplace. The abuser may also force the victim to miss work. The resulting spotty employment history can make it difficult to find a new job or find a landlord who trusts the victim can keep up with the rent.

Palmore said her ex-husband came to the loan agency where she worked, and yelled expletives at her co-workers. She almost lost her job. “I was working overtime to make money to give to him,” said Palmore. “He followed me to church and called my pastor a b***.”

Money may seem less important or less dangerous than physical abuse, but financial resources have a huge impact on survivors’ access to safety, according to Pentico. When abuse survivors enter shelters to seek help, it may take a few tries to sever ties with an abuser, often because of economic abuse.

“Addressing the economics of survivors is what really helps them move from short-term security to long-term safety,” Pentico said. “Moving someone to emergency housing for 30 days is great, but if her credit is ruined and she can’t access a job, then it is all pointless and she is vulnerable again.”

In many cases, survivors rely on legal aid and financial education to escape debt. Many organizations like New Endeavors by Women will teach their clients financial literacy as well as how to budget. Other organizations, like Tzedek D.C., provide legal aid to people in debt. The organization, located at University of the District of Columbia, also launched a fellowship program in April to send attorneys to work at nonprofits nationwide to provide legal aid for victims of domestic violence and other crimes.

“I am getting ready to sign up for a financial literacy class,” said Palmore, now 38 years after her ex-husband’s abuse. “When we [survivors] get money, if you’ve never had it to spend, you’re gonna spend it on things you don’t need. I’m getting better now: if I don’t need it, I don’t buy it.”

In some situations, abusers will prevent women from accessing legal aid, grant money or other resources. Pentico described another client who slowly saved $2,600 to hire an attorney by putting every extra dollar she could into a tampon applicator. She filled an entire box that way.

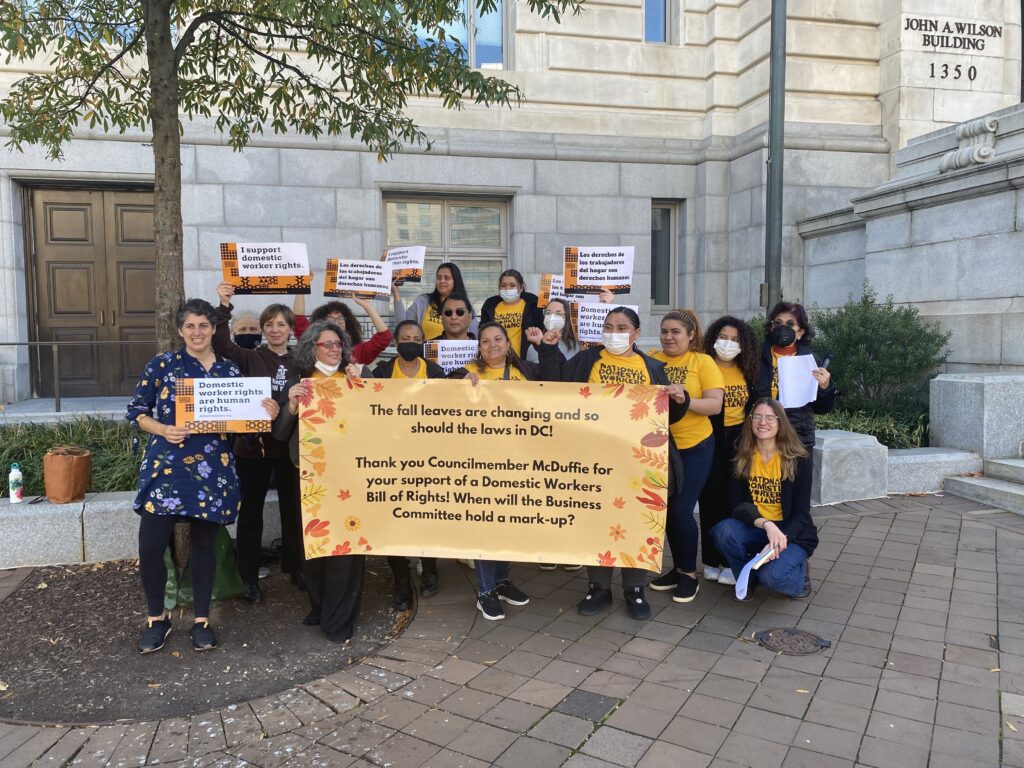

Lisa Jacobs, the Just Solutions CEO, is working with others to lobby Congress for reauthorization of the Violence Against Women Act to include a definition of financial abuse. The law was set to expire on Sept. 30 originally, and was extended to Dec. 7. VAWA legally defines domestic violence and funds social service agencies that aid victims of sexual assault. By expanding the definition of domestic violence in VAWA to include financial abuse, Jacobs said offices supported by the act could then receive grants to provide financial assistance, training and support.

“We had nothing back then,” Palmore said, thinking back to 1980. After her ex-husband got fed up with Palmore’s refusal to give him her money, he drove her home from work, towards the Anacostia River.

“He said ‘b***, I don’t care nothing about you or the kids.’ He gunned his car to drive me into the river. It’s through God that I’m still here,” Palamore said.

Now, Palmore serves on the Fairfax County Domestic Violence Prevention Policy Coordinating Council, as well as the Fairfax County Region I Area Resource Team. Both committees work to prevent domestic violence. She recently met with the Fairfax Police Department to learn about new domestic violence laws and policies in the county.

Of the peer support network she co-founded, Palmore said she will answer her phone at 3 or 4 o’clock in the morning to talk to women going through hard times.

“God kept me here for a reason,” she said. ”And I know that now.”