For years, Minister Xavier Justice began each and every workday with the same ritual –– treating himself to a coffee and cookie at Starbucks.

Sometimes, he chose a green tea over his usual white chocolate latte. Others, he chose a peanut butter cookie over a chocolate chip one. But every day, he spent around $7 on his snack.

Now, because of a new program called EduSaveDC, Justice is cutting out that habit by learning how to recreate the delicacies at home. Consequently, he is on the way to putting $2,000 in his child’s savings account by Christmas.

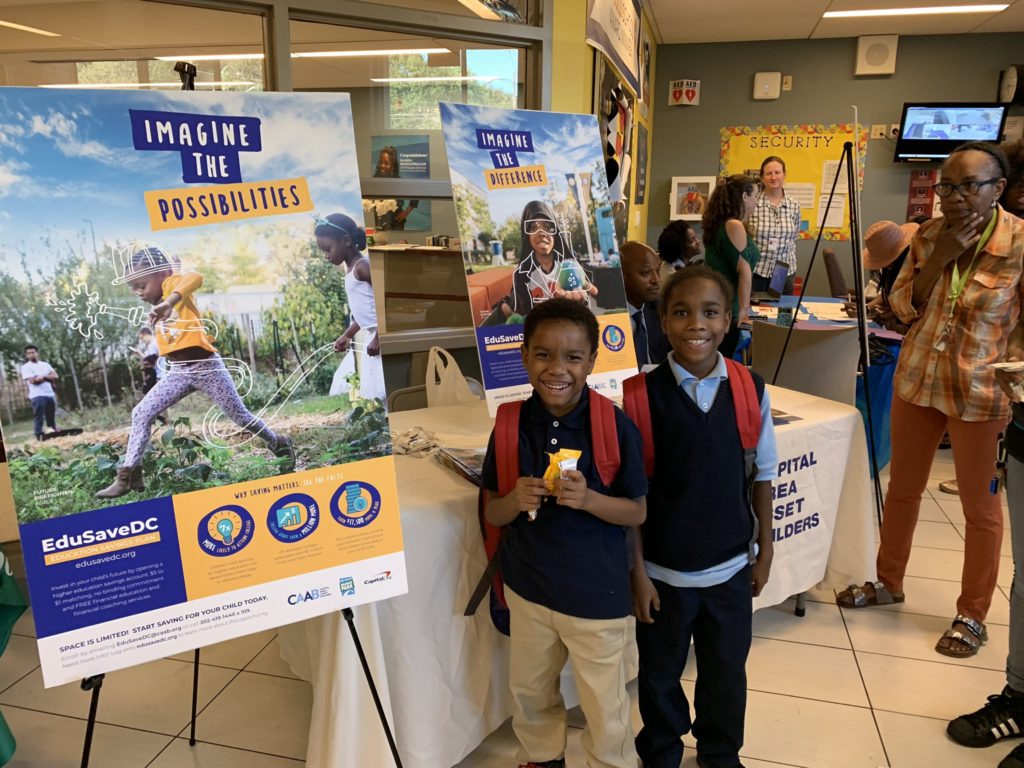

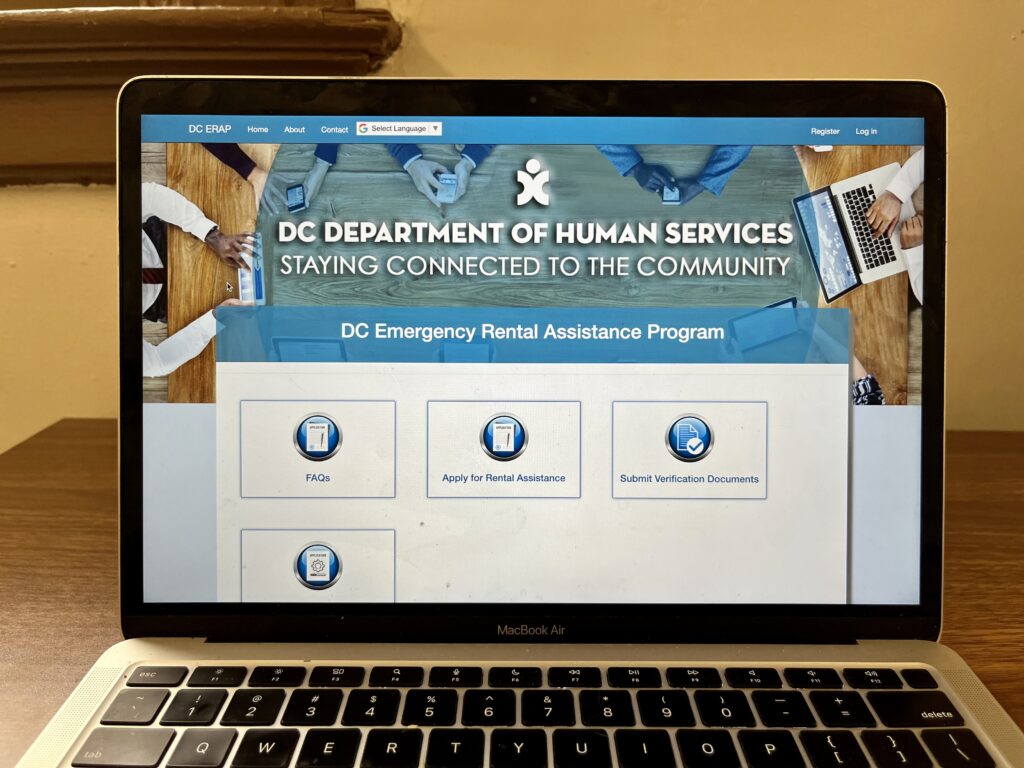

The initiative, which was created by Capital Area Asset Builders and the 11th Street Bridge Park Project, helps individuals like Justice — who earn a low to moderate income and live in Ward 8 with kids in the Districts’ elementary or middle schools — set up and build on children’s savings accounts.

“[We’re] guided by a vision of a metropolitan region where the birthplace, the race, or the zip code we live in do not limit economic prosperity or optimism,” said Joseph Leitmann-Santa Cruz, CAAB’s executive director.

For every $1 saved, $5 is deposited. Participants have the entire duration of the program, which started in February and ends in August 2020, to save the maximum of $300, for which an additional $1500 is added. Participating families also develop a budget and gain access to financial coaching classes. The program is funded by Capital One.

“It was a game changer for me,” said Justice, who used the program to begin saving for his fifth grader’s education. “This is the first time that I’ve got to be that forward thinking. No one’s ever put that in my mind before. And I think that will be a real good head start to get [my son] started, whatever he needs it for.”

The program has enough money for 110 families to participate but only half that many have signed up. Leitmann-Santa Cruz said one of the main factors that people do not participate is that they feel they are already stretched too thin financially.

“[They say] ‘Hey, I want to do this. But I’m living paycheck to paycheck and I cannot be saving money for my kids’ college when right now I’m struggling to put food on the table,’” he explained. “So, we definitely understand that.”

According to new data released by the United States Census Bureau last

month, about 16.2 percent of the population in D.C. lives in poverty. An article analyzing the data noted that the District had the largest income gap between the rich and the poor.

Vaughn Perry, the equitable development manager for the 11th Street Bridge Park, agreed that day-to-day limitations make it hard for people to look towards their future.

“Some folks are just struggling to pay their bills now, whether that’s rent or keeping their lights on,” Perry said. “So it can be really difficult to focus on the future of their children or their grandchildren when they’re just focusing on how they’re gonna get past their current situation.”

Another issue is general distrust of financial institutions. Perry said people are often skeptical of the program because they think it’s “too good to be true.”

Kenneth Lampkin, the senior program manager at EduSaveDC, echoed this point.

“A lot of times when you hear ‘savings program,’ people automatically think it’s some type of scam,” Lampkin said.

This skepticism, Justice said, was one of the main reasons why it took him so long to commit to EduSaveDC.

“It took me a long long time, believe me when I tell you, before I finally got enough courage,” he said. “I just kept thinking to myself: ‘I don’t know, what if they run off with my money? What if they put it in the stock market and I lose all my money?’”

But Justice was pleasantly surprised when he met with EduSaveDC representatives to learn more.

“Slowly, I got to ask my questions and my fears ebbed away,” he said. “It’s easy to complain and think differently when you don’t have the facts. And when you don’t have enough information, that’s how your fears and your reluctance grow… but once you have your questions answered like I did, it’s a win-win.”[Text Wrapping Break]

Leitmann-Santa Cruz and Lampkin said that encouraging participants to come and at least learn about the policies is one of the big ways they hope to reach full capacity for participants.

Long term, they hope to expand the savings program to other wards and increase the funding.

Perry said the thinks the program just needs more time to advertise and gain recognition in the community. And for Lampkin, a native of Ward 8, building those bonds is about giving people a familiar face. Growing up in the area, his family also struggled with saving.

“My family has also went through some of the same struggles that they are going through,” Lampkin said. “Not only that, but D.C. is only so small. A lot of times what I’m finding is that somewhere along the line, I may know some of the families or somebody in that family. So that goes a long way.”

He said the program would have given him something to look forward to as a child.

“[EduSaveDC] gives families the ability to put the kids’ future in their hands. It gives the child something to hope for,” Lampkin said. “It definitely would have benefited me.”

Justice said he understands the worries of anyone who might be unsure of whether they have enough to put some money away or anyone suspicious of the program. But he encourages them to join anyway.

“If I can do it, I know everyone else can do it,” said Justice, who is looking past the program and now hopes to save enough to get a new apartment.