A pilot program that could help public housing tenants boost their credit scores was unanimously approved by D.C. Council earlier this month. However, with an unofficial start date and no funding until at least Spring 2019, it is difficult to determine how effective the bill will be.

Approximately 20,000 low-income families, seniors and people with disabilities rely on deeply-subsidized housing, with DCHA as their landlord, according to the agency’s website. The Public Housing Credit Building Pilot Program Act of 2017 requires that the D.C. Housing Authority (DCHA) create a program that gives residents who rely on the agency the option of having their monthly rent payments reported to credit bureaus.

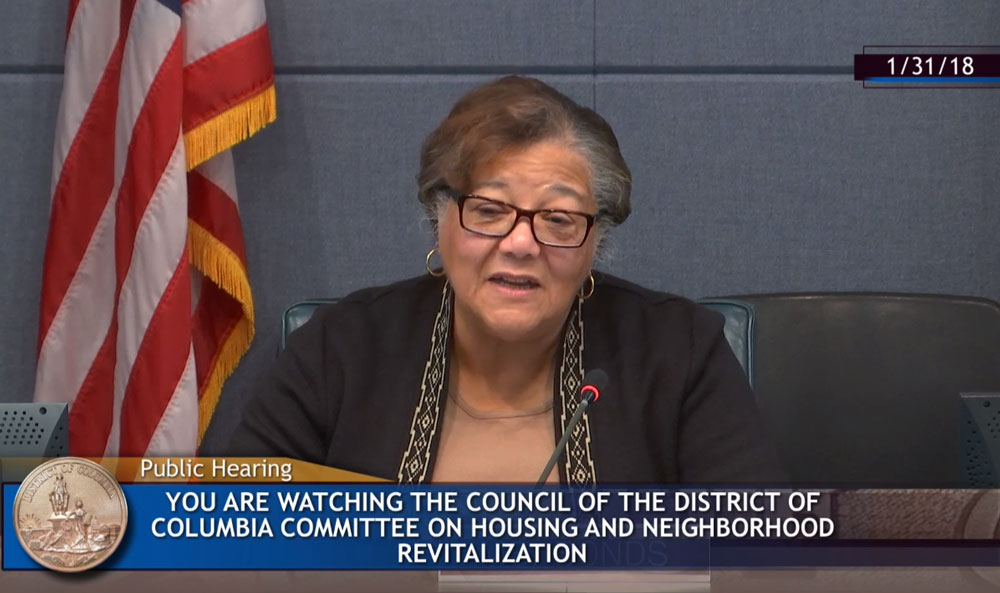

The bill, as estimated by The Committee on Housing and Neighborhood Revitalization, will cost taxpayers $156,755 — $116,118 for a full-time DCHA manager, $15,000 for a consultant and $17,500 for outreach and education, plus fees to the credit bureaus.

Most renters’ on-time housing payments are not reflected in their credit reports and therefore do not increase or decrease a tenant’s credit score. In competitive rental markets such as the District, a high credit score can often make the difference between a rental application being accepted or rejected.

In preparing this program, at-large Democratic Councilmember Anita Bonds, chair of the Committee on Housing and Neighborhood Revitalization, worked with the Credit Builders Alliance (CBA), a national nonprofit dedicated to helping low and moderate income households build their finances. They modeled the bill after the success of CBA’s 2012 nationwide program that helped tenants build credit via monthly rent installments, according to the Washington Times.

Between 2013 and 2014, 1,255 low-income residents engaged in rental reporting were spread among eight affordable housing providers (AHPs) across the country. With help from CBA, these AHPs were credentialed with Experian RentBureau — a specialty credit reporting agency and the first major credit bureau to incorporate positive rental payment into tenant credit files, according to CBA’s report.

Though program participants experienced an average increase in their credit score of 23 points or higher, 14 percent saw no change and seven percent noticed a decrease in their score.

“Rent reporting is seen by renters as a good opportunity for credit building. Ninety-seven percent of residents who responded to a survey on the pilot said paying rent on time is a good way for them to build their credit,” according to the report.

However, tenant participation may be less active than this report suggests. The New York City Housing Authority (NYCHA) has its own version of this program, and during October of 2017 only one person was enrolled, according to the New York Times (NYT).

A recent analysis by NYC Comptroller Scott Stringer suggests reporting rent payments could raise many tenants from a rating of “unscorable” to 700, or “prime.” The report also demonstrates the lack of access to extension disproportionally affects communities of color. His office was unable to disclose tenant enrollment figures at this time.

Both the CBA and Stringer’s office reported a majority of tenants who opted-in to reporting their rent payments benefited, while a slim percentage noticed a decrease in their scores. That slim percentage worries Shavannie Braham, a housing attorney for Legal Aid of the District of Columbia. Braham told the Washington Times that D.C.’s new legislation does not protect tenants who do not make payments because they are exercising their right to withhold rent due to poor housing conditions

Advocacy Director for Bread for the City Aja Taylor said the organization testified on behalf of B22-0168, The Public Housing Credit Building Pilot Program Act of 2017, in January. The agency, which serves D.C.’s low-income community, was generally supportive of the bill but also had reservations. These include a tenant’s ability to opt in and out of the program without penalty, parameters set forth by DCHA that ensure the program is assisting those who have the greatest chance of success and DCHA’s responsibility to uphold a process that corrects erroneous reports.

She added that someone who is able to build their credit through this program will still have trouble securing housing because there is not enough affordable housing to meet demand.

“While building and repairing credit is important, credit is not the foremost issue inside of public housing properties. Too many public housing properties suffer from poor maintenance, often resulting in the elimination or privatization of the property altogether,” Taylor said.

As of 2016, Attorney General Karl Racine’s office has taken legal action against Sanford Capital, the Bethesda-based landlord, for failing to meet suitable living standards for multiple violations of the District’s housing laws, according to Washington City Paper.

Many considered living conditions at Sanford properties to be unsafe. Bathtubs overflowing with liquid feces that form a gelatinous coat on bathroom floors is understandably a reason why a credit building program that threatens a tenant’s ability to withhold rent might raise concern.

Legal disputes with Racine’s office have forced Sanford to divest its remaining properties to the city and exit the housing market for the next seven years, according to Washington City Paper.

When asked if addressing a tenant’s right to protest poor living conditions has been an issue, a spokesperson from Stringer’s office said the Comptroller is adamant that rent reporting should not interfere and only supports opt-in, opt-out programs that allow tenants to withdraw their permission to report rent if their housing circumstances change.

The spokesperson added that tenants have additional protections, including the Fair Credit Reporting Act. This grants them the right to dispute any inaccurate information directly with the credit bureau including the inclusion of negative rent information.

DCHA currently provides several resources to help residents move toward self-sufficiency, including a tool that sifts through D.C. housing options and a program that gradually increases tenants’ income when they secure employment. The agency has not determined how the pilot project will work alongside these other programs.

“DCHA looks forward to studying this issue and will further review. In the meantime, DCHA will refine existing initiatives so that we can expand our efforts to create more opportunities to empower residents,” said DCHA Public Affairs and Communications Correspondent Christy Goodman.

A link to the full D.C. Council hearing can be found here.

The collaborative body of work for D.C. is cataloged at https://dchomelesscrisis.press.